What Are Security Benefit Fixed Annuity Rates?

Security Benefit fixed annuity rates are a type of investment option offered by Security Benefit Corporation that provide a guaranteed rate of return over a specified period of time. These rates are typically higher than traditional savings accounts, making them a popular choice for individuals looking to secure their financial future.

Fixed annuities work by allowing individuals to invest a lump sum of money with an insurance company, which then pays out a fixed amount of interest over a set period of time. This provides a stable source of income for retirees or individuals looking to supplement their existing income.

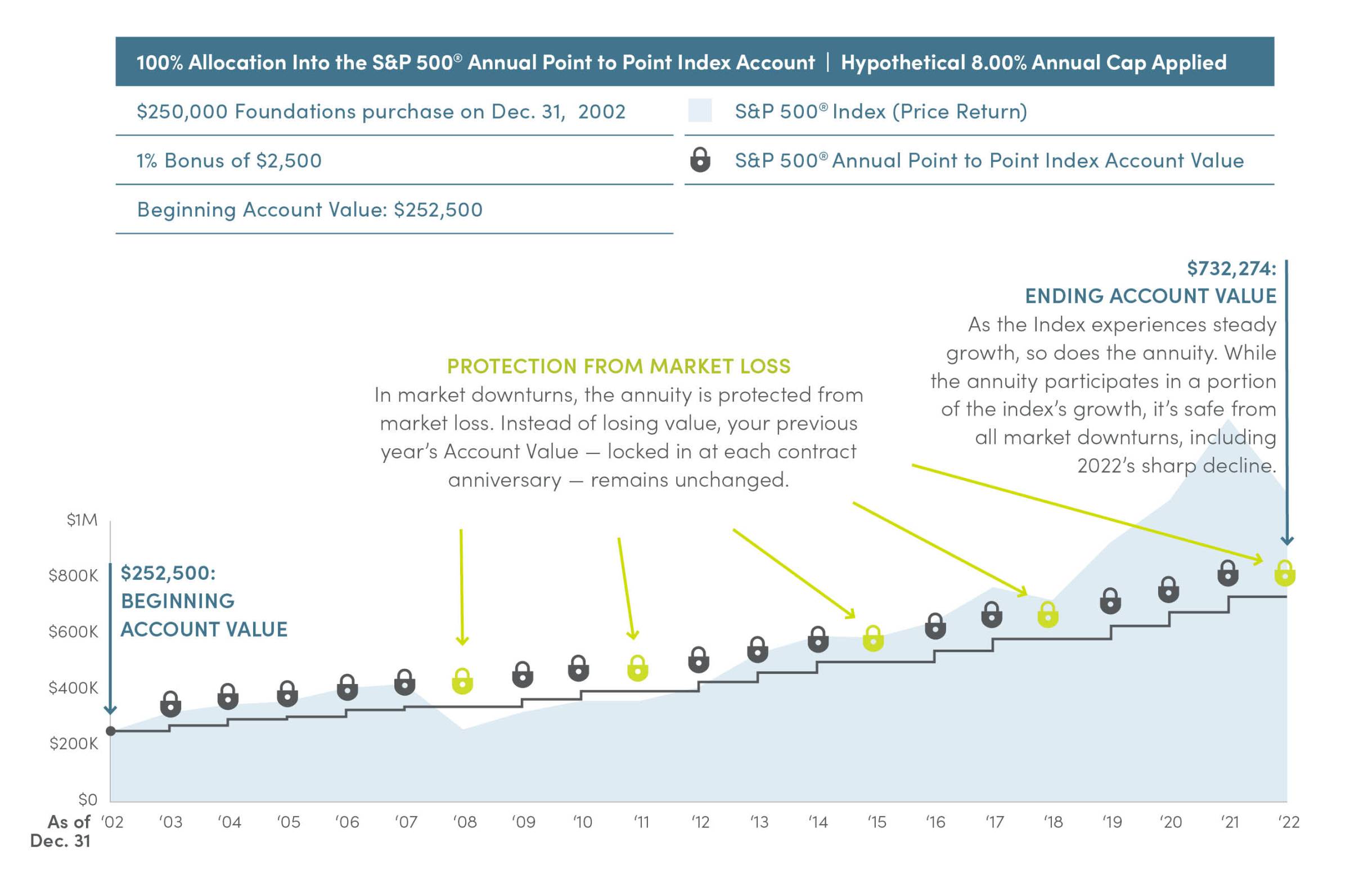

One of the main benefits of Security Benefit fixed annuity rates is the security they provide. Unlike other investment options, such as stocks or mutual funds, fixed annuities guarantee a minimum rate of return, protecting investors from market fluctuations.

Conclusion

Security Benefit fixed annuity rates offer a secure and stable investment option for individuals looking to grow their wealth over time. With guaranteed rates of return and the potential for long-term financial growth, these annuities are a popular choice for those seeking to secure their financial future.

FAQs

Q: Are Security Benefit fixed annuity rates guaranteed?

A: Yes, Security Benefit fixed annuity rates are guaranteed by the insurance company, providing investors with a secure source of income.

Q: What is the minimum investment required for a Security Benefit fixed annuity?

A: The minimum investment required for a Security Benefit fixed annuity varies depending on the specific product, but generally ranges from $5,000 to $10,000.

Q: Can I withdraw my money from a Security Benefit fixed annuity early?

A: While it is possible to withdraw money from a fixed annuity early, there may be penalties and fees associated with early withdrawals. It is important to carefully consider the terms of the annuity before making any decisions.

Q: Are Security Benefit fixed annuity rates taxable?

A: The interest earned on a fixed annuity is taxable as ordinary income, similar to interest earned on a savings account. However, the principal investment is not subject to taxation until it is withdrawn.

Q: How do I choose the right Security Benefit fixed annuity for me?

A: When choosing a Security Benefit fixed annuity, consider factors such as your investment goals, risk tolerance, and time horizon. It may be helpful to consult with a financial advisor to determine the best option for your individual needs.