What are Top Voluntary benefits Carriers?

Voluntary benefits are additional insurance products that employees can choose to purchase through their employer. These benefits are typically offered at a group rate, making them more affordable than if an individual were to purchase them on their own. Top voluntary benefits carriers are insurance companies that specialize in providing these types of supplemental coverage to employees.

Benefits of Choosing Top Voluntary Benefits Carriers

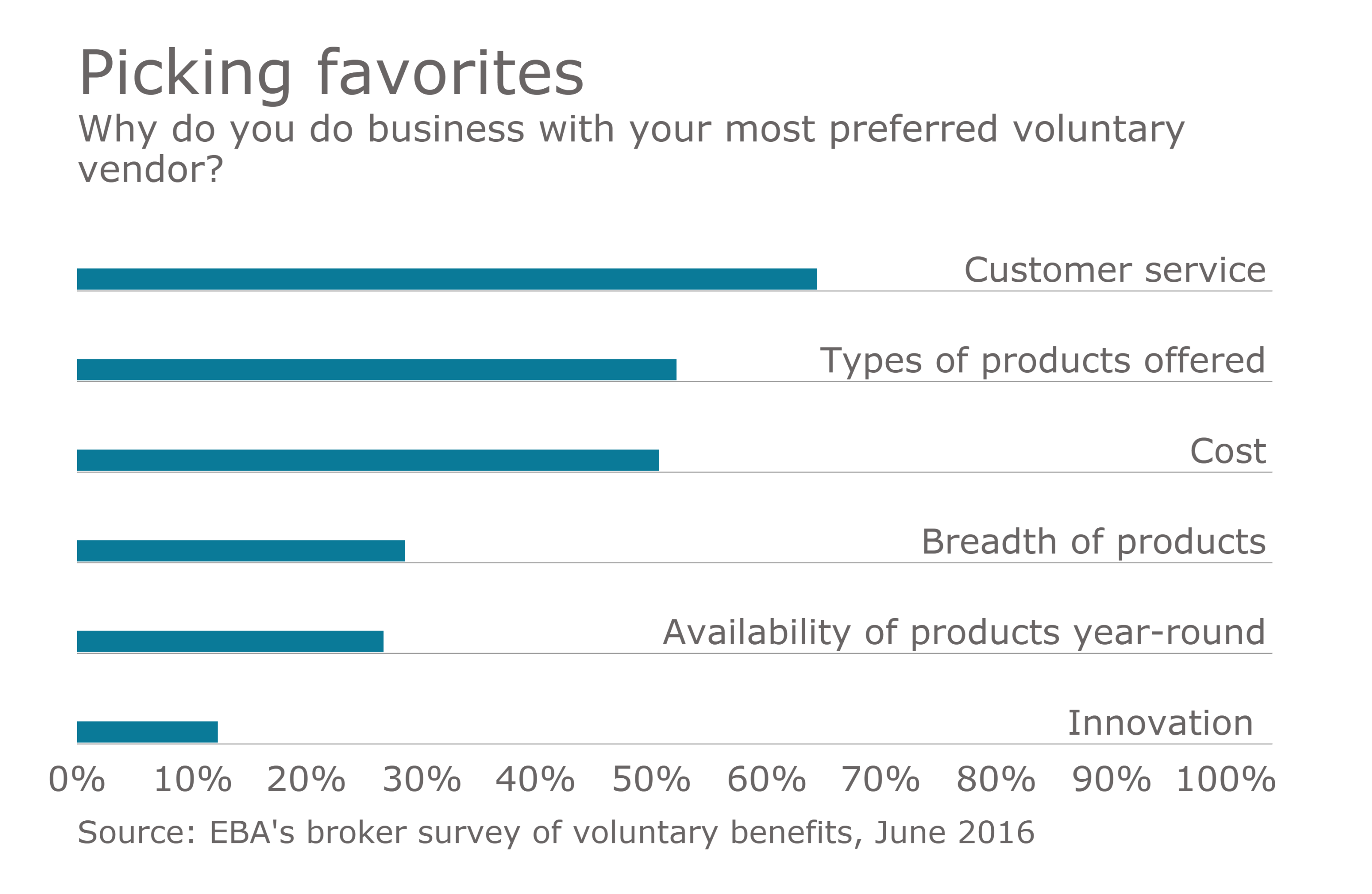

There are several advantages to selecting a top voluntary benefits carrier for your supplemental insurance needs. These carriers often have a wide range of products to choose from, allowing employees to tailor their coverage to their specific needs. Additionally, top carriers typically have strong customer service teams in place to assist employees with any questions or issues that may arise.

Some of the Top Voluntary Benefits Carriers

1. MetLife

2. Unum

3. Aflac

4. Colonial Life

5. The Hartford

Conclusion

Choosing a top voluntary benefits carrier can provide employees with peace of mind knowing that they have access to affordable supplemental insurance coverage. These carriers offer a variety of products and excellent customer service, making them a great choice for employers looking to enhance their benefits package.

FAQs

1. How do I know if my employer offers voluntary benefits through a top carrier?

Check with your HR department or employee benefits coordinator to see if voluntary benefits are offered through a top carrier.

2. Can I purchase voluntary benefits on my own if my employer does not offer them?

Yes, many top carriers offer voluntary benefits directly to individuals, outside of an employer-sponsored plan.

3. Are voluntary benefits worth the cost?

Voluntary benefits can provide valuable coverage at an affordable rate, making them a worthwhile investment for many employees.

4. Can I change my voluntary benefits selections at any time?

Typically, employees can only make changes to their voluntary benefits selections during open enrollment periods or qualifying life events.

5. How do I file a claim with a top voluntary benefits carrier?

Contact your carrier directly or speak with your HR department for assistance with filing a claim for voluntary benefits coverage.