The Northern Trust Company Benefit Payment Services 1099-R

Have you ever received a 1099-R form from The Northern Trust Company Benefit Payment Services and wondered what it is all about? Well, you’re in the right place! Let’s break it down in simple terms.

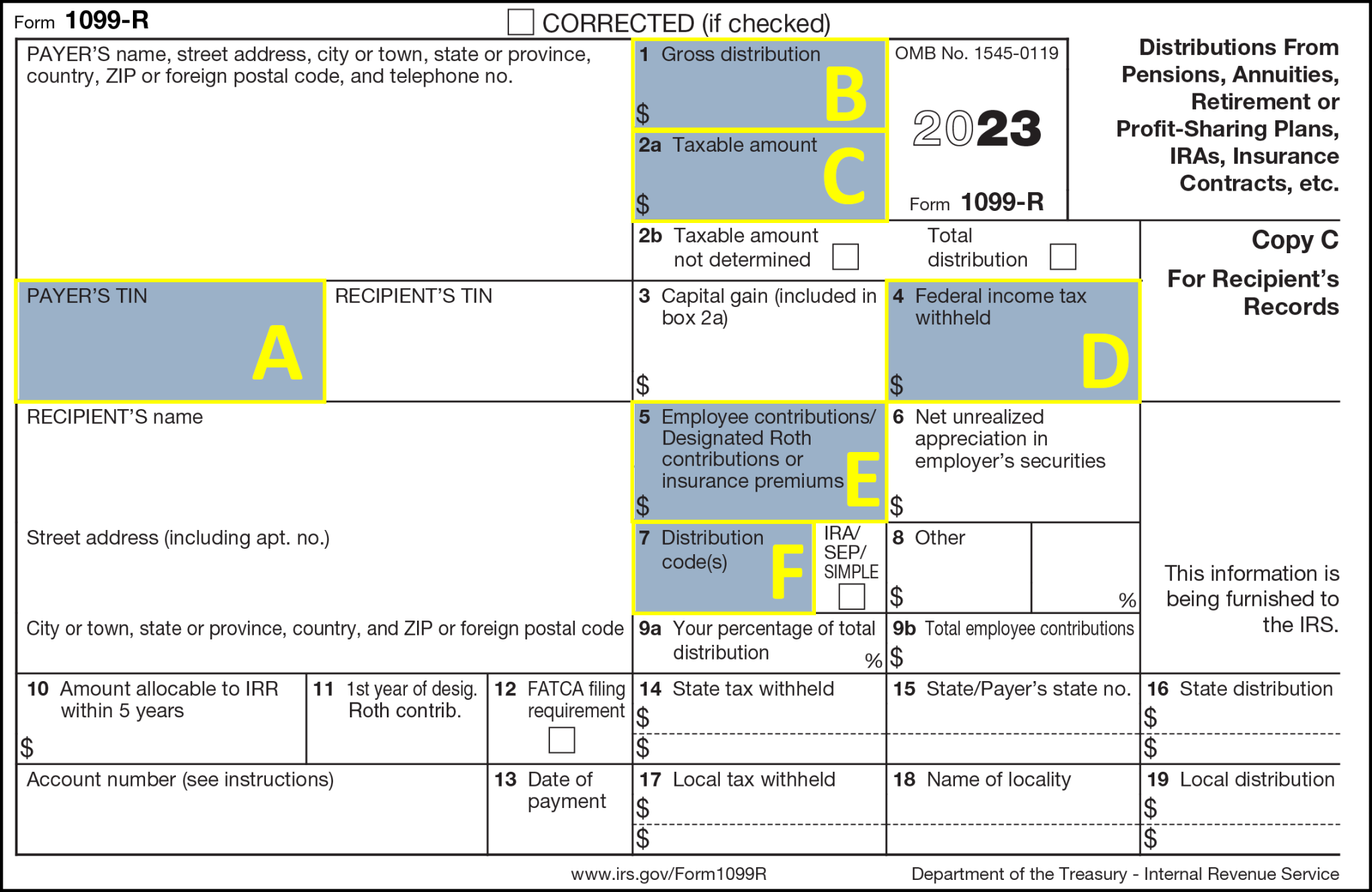

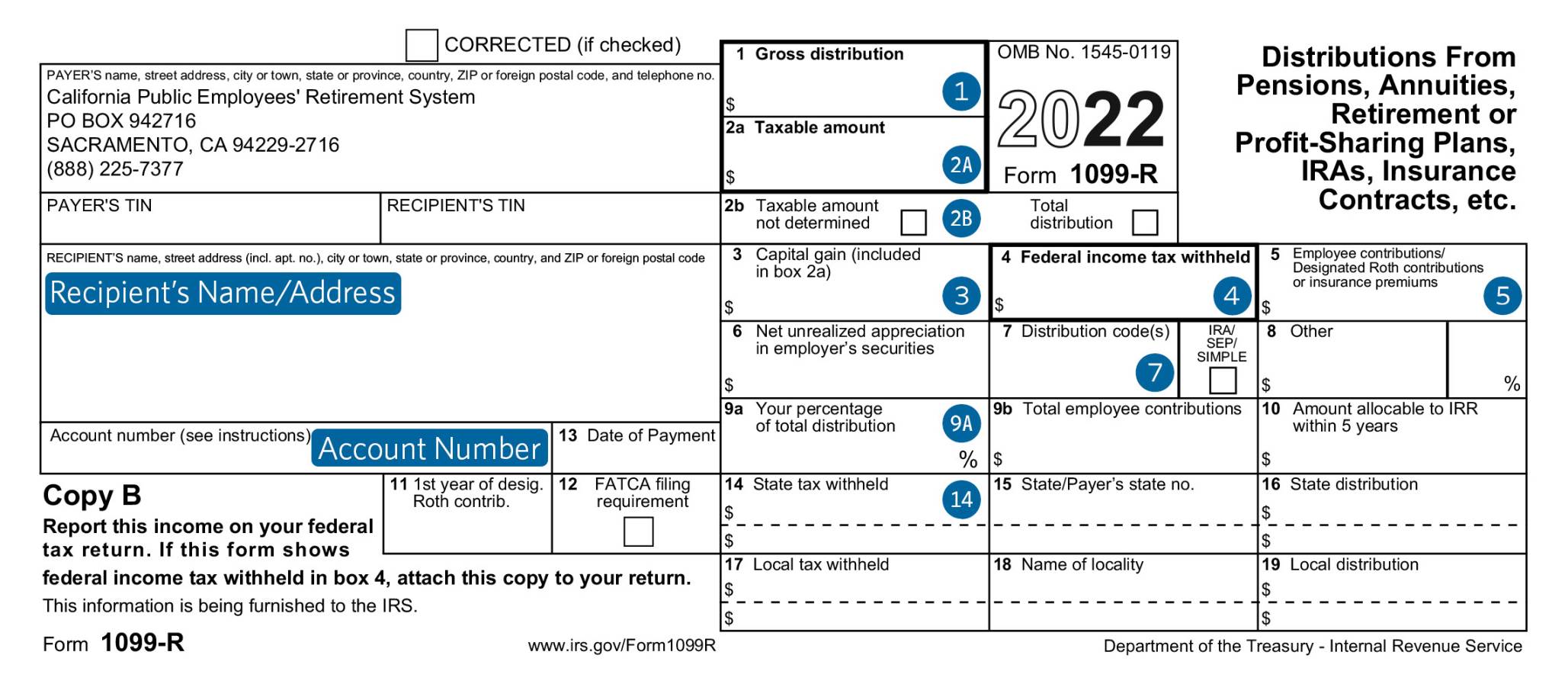

First of all, The Northern Trust Company is a financial institution that provides a range of services, including benefit payment services. A 1099-R form is a tax document that reports distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, and more.

When you receive a 1099-R form from The Northern Trust Company Benefit Payment Services, it means that you have received a distribution from one of your retirement accounts or benefits. This distribution is typically subject to income tax and may also be subject to additional taxes or penalties depending on your age and the type of account.

It’s important to review your 1099-R form carefully and report the information accurately on your tax return to avoid any potential issues with the IRS.

Conclusion

Understanding the 1099-R form from The Northern Trust Company Benefit Payment Services is essential for properly reporting your retirement account distributions and avoiding any tax-related issues. Make sure to consult with a tax professional if you have any questions or concerns about your 1099-R form.

FAQs

Q: What should I do if I receive a 1099-R form from The Northern Trust Company Benefit Payment Services?

A: Review the form carefully and report the information accurately on your tax return.

Q: Are distributions from retirement accounts taxable?

A: Yes, most distributions from retirement accounts are subject to income tax.

Q: Are there any exceptions to the taxability of retirement account distributions?

A: Yes, some distributions may be tax-free or subject to special tax treatment, depending on the circumstances.

Q: Can I roll over a distribution from a retirement account to avoid taxes?

A: Yes, in some cases, you may be able to roll over a distribution to another retirement account within a certain time frame to avoid immediate taxation.

Q: What should I do if I have questions about my 1099-R form or retirement account distributions?

A: Consult with a tax professional or financial advisor for personalized advice and guidance.